When you hit the road with open-ended travel plans, everyone still wants to know: “Where to next?”

Not having a destination or time-frame in which to get there really throws people for a loop – including the financial institutions you interact with on a regular basis. Read on to find out how to avoid the embarrassment and hassle of getting your card declined while you’re on the move.

Let your bank know your travel plans, or else!

Declined at the Register

Last month we packed up our summer cabin and hit the road to fly south for winter. Within a couple of weeks we traveled from Colorado to New Mexico, Arizona and Nevada. Along the way, we needed to buy a new trailer tire in Arizona, on a Sunday. As usual, a WalMart was the only game in town that was open to save the day.

Their automotive services team took care of us quickly and efficiently which made us happy. But immediately after my husband handed over our bank card to pay for the tire and installation, the clerk handed it back to him with a cash register printout that said:

‘DECLINED’

Declined at the register.

Knowing we had enough funds to cover the tire, my stubborn nature refused to hand over our backup card to the clerk. I was going to get to the bottom of this!

I called the bank and during the 15 minutes I was on hold I was overwhelmed with deja vu. This has happened before, and for no reason other than we were moving quickly across several states, using our cards at gas stations and retailers.

When a clerk finally came on the line, I explained our situation:

“We are full-time travelers,” I said in my most patient tone. “We never stay in one place very long. I need you to note in our account that we will be moving through a lot of states for the foreseeable future. We can’t keep getting declined like this.”

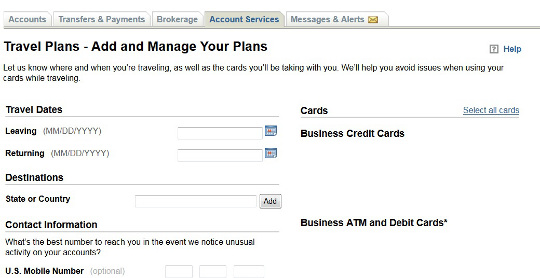

“Oh that’s no problem Ms. Agredano,” she said. “Just go online into your account services and fill out a Travel Plan.”

“A travel plan?” I said.

“Yes, that will tell us that you are traveling, where you’ll be and for how long.”

“So I have to put a time-frame on it?” I asked her.

“Well yes.”

At that point I knew there was no fighting the banking bureaucracy. “OK fine, I’ll check it out.”

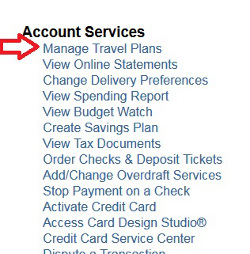

The clerk unlocked our card and we were able to pay. Later, I went online as instructed and indeed found a “Manage Travel Plans” in our account services menu.

Tell Your Bank You’re on the Move

Look for “Account Services” in your bank’s website.

It’s easy enough. I can tell the bank where I’ll be traveling so that as we move through those areas, our card won’t get declined.

The only problem? I can only create a plan for three months at a time! Hopefully your bank is different.

Banking has changed but one thing hasn’t – the bankers still don’t have a clue that there are nomads like us who don’t stay in one place for very long – at least nomads who don’t keep cash in a coffee can under the bed.

When you hit the road for good, you’ll find that institutions still want to put you in a box. You know and I both know it’s impossible to do that to a full-time RVer, but we need to work around it as best as we can. Letting your bank know you’re always on the go is one way to do that, and avoid the hassle of getting declined at the register.

I used my bank card’s online travel planning page and they still declined my card. I had to spend a half hour on the phone with them in order to pay for gas. Apparently, the two systems aren’t connected so the office of fraud prevention didn’t know I had registered my travel plans online. What’s the point?

Wow Lindsay that’s a bummer! I will reply back if I run into that problem with my bank. I just have to keep reminding myself, the hassles are for my protection….ugh.

We travelled all summer and my regular bank card gave me problems, but my credit union card didn’t. So on the second leg of our trip I switched all travel funds to the CU.

I ran into this several years ago on a trip our gas card was declined at a station and had to call the company to get it released.

If you bank with a credit union you can use the program “voucher for cash”. It’s honered everywhere just like traveler’s checks are. Carry some cash as well and you’ll go through shopping much faster. No one except people you choose have to know what your travel plans are.

Hmmm, we might have to look into credit unions again, it’s been a while. But it seems that this might be a good way for full-timers to go. Thanks for the tips!

This happened to me with a credit card on a recent trip to Mexico. I had called in advance and let them know where I’d be. Interestingly enough, my husband’s card, on the same exact account, was approved in the same store where mine was rejected. After the first time this happened, I called from Mexico and they apologized and said it wouldn’t happen again. But it did. There is no perfect solution!

Janet that is too funny and irritating for you too. I hope the bank paid for the long distance phone call. Grr.